2018 Business Updates

November 2, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

Amenability Test Results

Overview On October 25, 2018 ECPN received from our metallurgical laboratory the results and analysis from the Amenability Tests performed on samples previously submitted by Dr. Clyde Smith. Some of the observations taken into consideration for this undertaking were as follows:

- Precious metals concentrations of these samples consist mostly of gold and some platinum,

- Procedure consists of crushing material to talcum power consistency and separating the magnetic material from the non-magnetic material,

- Three recovery processes are used to determine maximum extraction level,

- None of the processes and/or procedures are out of the norm of metallurgical laboratories protocols,

- Precious metals concentrations appear to occur in the non-magnetic (hematite rich) fraction of the samples,

- In higher grade samples, i.e.: EC-10 and EC-11, the gold values seem to be in very fine size (<1.0µ) free particles.

- The mode of occurrence of the platinum is presently unknown and should probably be investigated further with microprobe analysis.

The gold and silver recovery processes deemed suitable for investigation for the purposes of this amenability testing are:

- Sodium Cyanide leach,

- Sodium and/or Ammonium Thiosulfate leach,

- Thiourea leach.

Sample Selection and Preparation

- Samples identified as EC-10 and EC-11, weighing 20.15 kg and 21.65 kg respectively,

- Crushed through a jaw crusher and reduced to all passing -1/4” size,

- Samples were further milled by passing them through an 8” roll mill followed by a disc pulverizer,

- Final particle size attained was all -100 mesh (-150μm).

A 1,000-gram aliquot of each sample was split and magnetically separated across an Eriez laboratory scale belt magnetic concentrator (Model: ERIEZ MFX/ 5-1 RE LAB SEP) yielding the following fractions:

| Sample Number: | Magnetic Fraction: (wt%) | Non-magnetic Fraction: (wt%) |

| EC – 10 | 46.5 | 53.5 |

| EC – 11 | 59.2 | 40.8 |

Table 1: Percentage of non-magnetic fraction in the samples EC-10 and EC-11 from El Capitan Mine, Lincoln County, NM used in the Extraction Procedures Development work. All hydrometallurgical leach amenability tests performed and reported in the following pages of this report were at 30 gram (1 Assay Ton) size.

Amenability Test Results

- Sodium Cyanide leach

Ore : 30 grams (1AT)

Water : 100 mL

NaCN : 1.0 %

CaO : 0.5 % %

Solids : 23 %

Oxidizer : Yes

T : Room Temp. (~20C)

t : 4 hrs.

| Sample ID: | Gold Assay (Calc) (opt) | Gold Recovered (opt) | Recovery (%) |

| EC – 10 Non-mag | 0.189 | ||

| 4738C | 0.178 | 94.2% | |

| 4739C | 0.178 | 94.2% | |

| 4740C | 0.180 | 95.2% | |

| EC – 11 Non-mag | 0.266 | ||

| 4744C | 0.233 | 87.6% | |

| 4745C | 0.230 | 86.5% | |

| 4746C | 0.238 | 89.5% |

Table 2: Sodium Cyanide leach amenability test results performed on samples EC-10 and EC-11 and recovery percentages.

- Sodium and/or Ammonium Thiosulfate leach,

Ore : 30 gram (1AT)

Water : 100 mL

NaOH : 0.375 M

Na2S2O3.5H2O. : 0.1M %

Solids : 30 %

pH : 10.5

Oxidizer : Yes

T : Room Temp. (~20C)

t : 48 hrs.

| Sample ID: | Gold Assay (Calc) (opt) | Gold Recovered (opt) | Recovery (%) |

| EC -10 Non-mag | 0.189 | ||

| 4749C | 0.180 | 95.2% | |

| 4750C | 0.177 | 93.7% | |

| EC-11 Non-mag | 0.266 | ||

| 4753C | 0.248 | 93.2% | |

| 4754C | 0.241 | 90.6% |

Table 3: Sodium Thiosulfate leach amenability test results performed on samples EC-10 and EC-11 and recovery percentages.

- Thiourea leach.

Ore : 30 gram (1AT)

Water : 190 mL

H2SO4 : 10 mL

NH2CSNH2 : 3.5 g

Fe2(SO4)3 : 0.5 g %

Solids : 15 %

T : Room Temp. (~20C)

t : 1.5 hrs.

| Sample ID: | Gold Assay (Calc) (opt) | Gold Recovered (opt) | Recovery (%) |

| EC -10 Non-mag | 0.189 | ||

| 4757C | 0.178 | 94.2% | |

| 4758C | 0.179 | 94.7% | |

| EC-11 Non-mag | 0.266 | ||

| 4761C | 0.245 | 92.1% | |

| 4762C | 0.238 | 89.5% |

Table 4: Thiourea leach amenability test results performed on samples EC-10 and EC-11 and recovery percentages.

Conclusions

All three laboratory-scale hydrometallurgical recovery methods tested under this project performed well, showing promising results varying from 82.9% to 97.6% and justifying further testing at bench scale and pilot scale levels. Across the three recovery methods the overall recovery was 0.2088 opt with 92.171% recovery percentage and this does not include the platinum metal group. Comparing these figures to the previously reported numbers in the 43-101 reported by Dr. Clyde Smith shows a significant increase in the recovered material. This increase can be attributed to the pre-treatment of the head ore via the fine grinding, isolating the precious metals, and removing the magnetic material. With the further testing to be performed at larger scale, other factors like the processing costs, plant costs, environmental costs, etc. for each of these methods will be determined and comparisons of their ROI (return on investment) will be detailed.

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

October 8, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

Operational Projections

There are potentially two streams of revenue available to ECPN, consisting of the precious metals and the iron ore. Our most recent testing indicated that roughly 50% of the head ore is magnetic and the remainder is non-magnetic. The head ore would be crushed via three separate crushers to a consistency of talcum powder and then processed through the AuraSource 1 machine, which is a magnetic separator. The magnetic material would be sold as a high-grade iron ore and the non-magnetic material would be concentrated using vat leaching and sold as concentrates to refineries.

Testing and Development

Amenability Testing – We have determined that there are precious metals on the property. The challenge has been to determine the percentage of the precious metals that can be recovered. These tests consist of grinding the material to a near talcum powder form, separating the magnetic material from the non-magnetic, using three chemical extraction methods on the non-magnetic material, and determining what percentage of the extracted material can be concentrated for recovery. When further information is available, we will release it to shareholders. Bench Scale Testing – We anticipate this test to begin this coming week. This is a small scale test using the most promising extraction method from the amenability test and will indicate how long the chemical vat leaching recovery will take. A few pounds of material will go thru the entire process to create a concentrate and we estimate this can be completed by the end of October 2018. Bulk Scale Testing – Plans have already been developed for this test. Three batches of material, with each batch consisting of one ton of head ore, will be extracted from the mine site by an independent third party and transported under chain of custody protocol to the processing facility. This test will provide the concentrations levels and the estimated operating costs to achieve those levels. We are hopeful this test can be completed by the end of this year. Pilot Plant – Upon successful completion of the Bulk Scale Testing, management intends to move forward with the construction of a Pilot Plant at the mine site. The planning for the plant is already underway. It is expected that the Company will engage a contract miner to extract and crush the material to the size required for separation. Using the pilot plant, the material will then be separated, with the iron ore to be sold into the secondary market, while the precious metals will be further concentrated and sent to a smelter for processing. Dependent upon financing and successful testing, the Company believes that the mine site pilot plant could be fully operational by the end of the second quarter of calendar year 2019.

Concentrates

We have recovered the four barrels of super concentrated material from Canada and initial testing by our metallurgist and mineralogist indicates that the material within these particular barrels is of no value. This is inconsistent with the testing that occurred prior to shipment to Canada, and Management is working diligently to investigate the reason for this anomaly and will update shareholders on the results of this investigation when appropriate.

Marketing and Sales

The two streams of revenue are very interesting to management. We are working diligently to bring these streams to reality. We are in the very early stages of developing relationships to sell the iron ore. We hope to have more information relative to these efforts. The precious metals will be a longer development, processing, and marketing cycle but have the potential to generate significant revenue.

Legal

ECPN is engaged as a defendant in two law suits. We are negotiating with the counterparties in both cases and hope to reach an amicable resolution of both in the near future. Due to limited resources, the Company is late on filing its filing obligations with the SEC, but management recognizes the importance of regaining compliance with its filing obligations and will do so as soon as practicable.

Financial

The Company is very thankful to the shareholders who have stepped to the table and provided working capital to keep the Company in business.

Capital Requirements

Management and the Board of Directors are currently working to raise additional capital to accomplish the previously mentioned tasks.

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

![]() Download this Business Update August 9, 2018

Download this Business Update August 9, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

Canadian Concentrates

The Canadian concentrates have been returned to ECPN and are currently being stored in a secure warehouse in Phoenix, under 24-hour video and audio surveillance, can only be observed with an independent observer and Board member present, and were sealed prior to shipment and have not been opened. Access to the concentrates is very limited. The concentrates prior to leaving Canada were under strict chain of custody protocol. An independent third party sampled the barrels taking three identical samples with the third party maintained a sample, the company whom ECPN contracted with to monetize the concentrates, and the last sample was forwarded via overnight shipment to ECPN’s metallurgical laboratory. After the concentrates were assayed the data was sent to Highlands Geoscience an independent mining consulting company operated by Dr. Clyde Smith and David Smith. Below is the report generated by David Smith regarding these concentrates. Highlands Geoscience 3803 NE 120th Street Seattle WA 98125 t 206-364-2554 m 206-390-2575 [email protected]

Results Of Recent Concentrate Sample Analyses

El Capitan Project, New Mexico

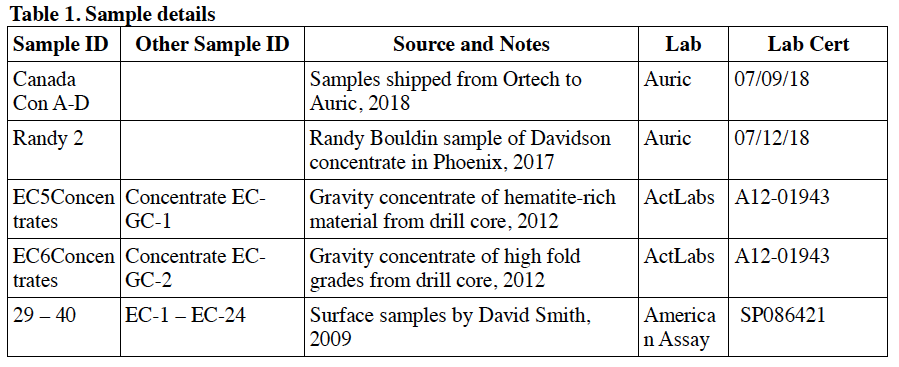

To: Chuck Mottley, El Capitan Precious Metals Inc. From: David Smith Date: July 20, 2018 Chuck Mottley of El Capitan Precious Metals recently forwarded to me two sets of analytical results from Metallurgical Labs. The results were from testing of five samples that reportedly were derived from mineral processing work conducted by David Davidson for the company in 2017 on material from the El Capitan project in New Mexico. Details of Davidson’s work are unknown, including the concentration methods. All five samples are reported to be concentrates from the Davidson work. One sample was taken by El Capitan employee Randy Bouldin as he observed the concentration work by Davidson at a pilot plant in Phoenix in 2017. Four samples were from barrels of concentrate reportedly shipped from the Davidson plant to Process Research Ortech in Mississauga, Canada, and then to Metallurgical Labs. Auric noticed a wide variation in some elements between the Bouldin sample (Randy 2) and the concentrates (Canada Con A – D). This memo summarizes the variations in composition between these samples. I also include comparisons with two other sets of samples from the project analyzed previously: 1) 10 surface samples collected by myself from the project in 2009 (D. Smith, 2009), and 2) two gravity concentrates produced by Research Development Lab from composite drill-core samples in 2012 (C. Smith, 2012). Table 1 lists details of the samples compared. It is important to note that I have no first-hand knowledge of the origin of the five “concentrate” samples (Randy 2, Canada Con A – D) and cannot verify chain of custody: all information about those samples has been reported to me by Chuck Mottley. The two other sample sets discussed in this memo were conveyed under intact chain of custody under my supervision in 2009 and 2012.

Major Elements

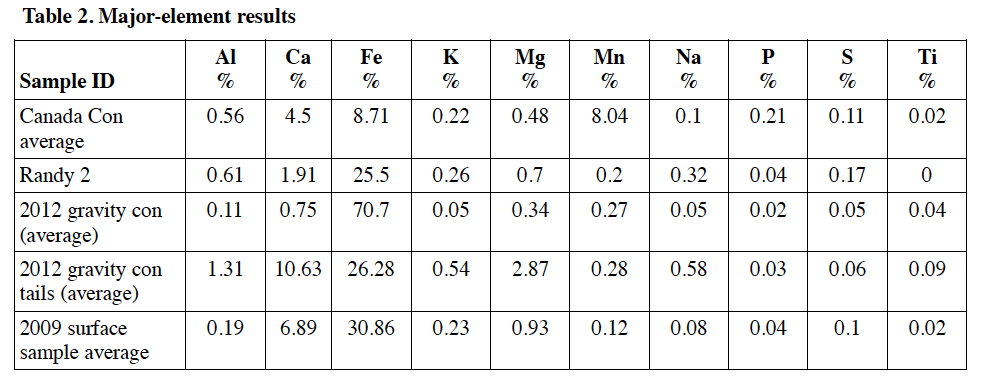

Table 2 lists analytical results of the major elements in the samples compared in this memo. The elements Fe, Mn, and P show large variations between the samples: in the Canada Con samples, Fe is lower and Mn and P are higher than in Randy 2, the average of the 2012 gravity concentrates, and the average of the 2009 surface samples. As well, Ca in the Canada Cons is considerably higher than Randy 2 and the 2012 concentrates, although similar to the 2009 surface sample average. These variations could possibly be caused by a gravity concentration method, with the Canada Cons being the lighter fraction; this would account for the lower Fe (carried in dense magnetite into a heavier fraction) and higher Ca (carbonate minerals carried to the lighter fraction). But this would not explain the extremely high level of Mn in the Canada Cons compared to the other samples, including Randy 2, which is reported to be the same material. There are no Mn-bearing minerals (rhodocrosite, rhodonite, pyrolusite, manganite, psilomelane) reported in the El Capitan deposit to explain such a high Mn result. Results of the major elements indicate that the Canada Cons are chemically distinct from the Randy 2 sample and the other samples known to be from the El Capitan property.

Precious Metals and Trace Elements

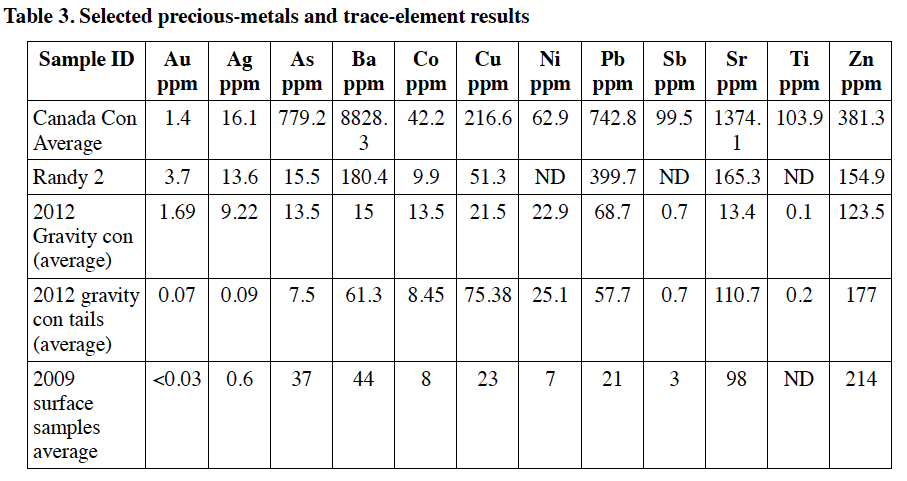

Table 3 shows results for Au, Ag, and the trace elements that showed wide variations among the samples compared. The Canada Cons showed lower Au than Randy 2 but Au in the range of the 2012 gravity concentrate. Ag was slightly elevated in the Canada Cons average compared to the other samples. The Canada Cons showed extremely high levels of the trace elements As, Ba, Sb, Sr, and Tl compared to the other samples. Co, Cu, Ni, Pb, and Zn were also elevated in the Canada Cons. These elements all occur in heavy minerals: Ba (barite), As (arsenopyrite), Co (cobaltite), Cu (copper sulfides), Ni (nickel sulfides), Pb (galena), Sb (stibnite), Sr (celestite), Tl (lorandite), and Zn (sphalerite). Thus, gravity methods or densemedia separation could potentially elevate these elements; however, most of these minerals have not been identified in the El Capitan mineralization, and these elements are not elevated in other gravity concentrates from the project.

Management Note

As a result of the information gathered from these samples management has initiated testing of the controlled samples of the concentrates selected prior to sealing of the barrels and shipment to Canada. Per the contract with the Canadian processor control samples were maintained by each party. The company received the original geological drilling report on gold and platinum from Dr Clyde Smith on January 31, 2007. There were 39 drill holes averaging 400 feet deep with samples taken every five feet. The samples returned from Canada and tested were a totally different material than the concentrates that were delivered to Canada for precious metal refining. And based upon this information provided by our Geologist and Metallurgist team the company has begun to turn over their information to the ECPN’s legal team and wait for their recommendations.

Moving Forward

With so much focus on the past we fail to recognize the significant progress being accomplished as we attempt to prove out the value of ECPN. We are currently working with the metallurgical laboratory along with the help of Highlands Geoscience of Seattle, Washington, Dr. Clyde Smith and David Smith, in a metallurgical testing program to determine the most efficient method to extract the precious metals from the ore. The first tests, known as an amenability test, will begin to indicate the percentage of recovery using the best extraction method. Based upon the assays previously reported the precious metals concentrations consist mostly of gold, silver, and platinum and occur in the non-magnetic fraction of the ore samples. Some higher-grade samples indicate gold values present as free particles. The ore will be tested for gold and silver using the following methods: Sodium Cyanide Leach, Sodium and/or Ammonium Thiosulfate Leach, and Thiourea Leach. And the testing of potential platinum will consist of Chlorine Leach and Sodium Cyanide leach followed by a Chlorine leach. Based on the results of these tests results and with input from our geological and metallurgical consultants ECPN will either complete amenability tests on additional samples or continue onto the bench scale testing with the most promising process(es). The final step would be Bulk Scale tests performing extractions utilizing the results from the aforementioned tests to develop costs of extraction and potential profitability. The Bulk Scale test will consist of processing approximately 1,000 lbs. of head ore through to creating precious metal concentrates and high-grade iron ore material. Successful results in these test will lay the ground work for a pilot plant. When the Bulk Scale tests are initiated management will finalize the contract with the contract miner. Upon the agreement for that arrangement a detailed Operating and Financial plan will be published along with all information regarding the contract miner and other consulting personnel; and there will not be a non-disclosure agreement. Our intermediate goal is to push forward proving out the value of this property by successfully completing the plan developed in conjunction with our geologist and metallurgist and develop a pilot plant. By completing this task the company will be in cash-flow positive structure and will be able to demonstrate to prospective partners and/or buyers that ECPN is a viable property for long term financial rewards. The company is in the process of raising capital to complete this project. The El Capitan Precious Metals, Inc. Board of Directors is totally committed to the company’s shareholders in maximizing the value of this company’s property. ![]() Download this Business Update July 2, 2018

Download this Business Update July 2, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

Return of Concentrates from Canada According to the shipper, the Company’s concentrates sent to Canada are currently in transit from Canada back to ECPN in Phoenix, Arizona. ECPN and J Duncan Reid of Mexico Metal Refiners Group, LLC (NMMRG), with assistance of counsel, developed a Protocol that maintained the chain of custody whereby neither party could infringe on the integrity of the material. The Company’s board member, Daniel Martinez, traveled to Canada to monitor the Protocol. This was accomplished using a third party who secured three samples from each barrel. One sample would be retained by ECPN, another would be retained by NMMRG, and the third sample would be held by the third party. Originally it was reported that there were only four barrels, but due to miscommunication there were actually 18 barrels: the original four barrels of concentrates and an additional 14 barrels of tailings purportedly from the pilot plant. The samples, all eighteen, in the possession of ECPN were immediately sent for analytical processing. This work is currently taking place and results will be published when available. All 18 barrels have been delivered to an independent secure warehouse in Phoenix and the Company anticipates they will be in its possession the first week of July. Ongoing Testing and Development Additional testing is anticipated to investigate recoverability of precious metals from mineralization on the El Capitan property. This testing will consist of a series of metallurgical amenability tests; if results warrant, these are to be followed by bench-scale extraction tests. Management has full intent to develop a pilot plant at the mine site after work on the mineralization has been completed. This is required due to the lack of operational data secured in the recent past. Management needs to determine the amount of material required to produce a high enough concentrate to meet industry standards. That data is currently not available. Report on Chinese Concentrates ECPN had reported earlier that Dr. Clyde Smith would be taking samples for testing from the returned Chinese concentrates. It had previously been understood that there were 20 tons of returned concentrates. Upon further investigation it was determined that only 11 barrels were returned, comprising less than 5,500 pounds, or 2.75 tons. When Dr. Smith was at the mine site performing sample collection it was determined that the Chinese concentrates were missing and could not be located. Our site manager has filed a police complaint and the missing barrels are under investigation. Board of Directors Resignation Effective June 25, 2018, John Stapleton resigned from the Board of Directors based upon his disagreement over the future direction of the Company. We thank him for his service and wish him the best. Effective July 1, 2018 two additional Directors—Doug Sanders and Bob Shirk—have also resigned from the Board. Former Board Chairman John Stapleton’s Letter of Resignation can be viewed here or via this link:

June 25, 2018 Mr. Tim Gay, Chairman of the Board of Directors Mr. John Balding, Acting CEO El Capitan Precious Metals, Inc. 5871 Honeysuckle Road Prescott, AZ 86305 Re: Letter of Resignation Gentlemen:

I hereby submit my resignation from the Board of Directors of El Capitan Precious Metals, Inc. (hereafter “ECPN”) effective immediately.

It has become abundantly clear that the current management and four members of the Board of Directors have chosen to only share limited and selective information about the business activities of ECPN with me and the other two Board Members. It is also clear that ECPN is not interested in going into production recovering precious metals from the ECPN ore utilizing the techniques developed in the Pilot Plant activity. Further, El Capitan has not published or responded to the executed Letter of Intent to sell 60,000 tons of iron ore per month for 10 years.

From the limited information that I have received, it appears that current Management has no strategy for taking ECPN forward. It is reverting to assaying as it did for almost 9 years during which it produced zero revenue. There is no plan for capitalizing ECPN to keep it viable. Under current circumstances, I believe a plan necessary. There is no plan to produce revenue on an on-going basis in spite of the commitment to have such a plan within three weeks of the firing of myself and driving away ECPN legal counsel.

I am very pessimistic about the future of ECPN without these specific plans, and I do not want to be a part of the demise of ECPN, in which I, my family, and my friends have so much invested.

My resignation, as well as your legal requirement to publish it, is the only honest update the shareholders are getting from the current Management.

Sincerely yours, El Capitan Precious Metals, Inc. John F Stapleton

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

![]() Download this Business Update June 6, 2018

Download this Business Update June 6, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

At this critical juncture in the Company’s history, it is imperative that the leadership team be advised by experienced problem solvers gifted with the ability to work well with other team members. The immediate requirement is to develop a clear and detailed plan which will drastically increase enterprise value and recover shareholder confidence. For that purpose, we believe we have assembled that team of outside advisors. Our Legal Team The Company has been guided by the first-rate consulting and securities law services of the Maslon Law Firm, working with Bill Mower and Alan Gilbert, for approximately 15 years. To complement that legal team, we have retained Jeff Proper, a proven expert, who, we believe, will guide us during this period of required austerity and day-to-day decision making. His resume is accessible via a hyperlink below. Jeff Proper has been working with Tim Gay for many years during which Tim served his clients as a business valuation expert, expert witness, and business consultant. Additionally, Jeff is well connected with Semple Marchal and Cooper, our independent accounting firm to which he has been providing legal services. Our Auditors As some may recall, the Company recently endured an almost catastrophic issue. Its long-time auditors chose, at the last minute, to resign the account due to what ultimately became a resolvable issue. Within three days, Tim Gay was able to retain Semple Marchal and Cooper as replacement auditors. Mr. Gay has had a decades-long association with that firm and has been serving as a principal and performing “concurring partner reviews” on SEC (public) audits. In order for the firm to perform the independent audit, Mr. Gay could no longer serve as a principal with the Firm nor can he perform the aforementioned reviews. Our long-term CFO, Steve Antol, due to Mr. Gay’s introduction decades ago, has worked with and is very familiar with the accounting firm and its partners. This made the transition relatively seamless. Antol and Gay met in the 1970s where they worked together on the audit staff of a national CPA firm. Over the past years, they have maintained a close professional and personal relationship. The Team In summary, the management and board of the ECPN has assembled a multi-talented, highly professional, close-knit, and qualified team. Many of these individuals have had very long-term relationships with each other. Mr. Gay continues to office at Semple Marchal and Cooper and maintains constant contact with our audit team comprised of Steve Marchal (audit partner), Paul Tomasik (audit manager), and Robert Semple (managing partner). We are working diligently to complete our operating plan for the near- and long-term future of ECPN. In the not-too-distant future, and when deemed meaningful and effective, it is our intention to call a Shareholders’ Meeting. In the meantime, it is our intention to keep our shareholders fully informed. Jeff Proper’s CV is available via this link: Jeffrey Proper Resume

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

![]() Download this Business Update May 23, 2018

Download this Business Update May 23, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

El Capitan Looks…

“Back to the Future”

Oftentimes, the best way to see the future is to look to the past. The Company plans to look back and come to terms with where it has been and where there are significant opportunities or procedures that were overlooked or missed. The only significant document regarding the property is the NI 43-101 dated January 6, 2014, written and certified by geologist Dr. Clyde Smith. In the mining industry, this document represents the ‘Holy Grail,’ and offers a road map of the property. The company has re-engaged Dr. Smith to provide consulting services and guidance in turning this property into a profitable endeavor. This action is required because the Company was left with no documentation related to the most recent Pilot Plant operations. We have no data regarding the levels of concentration of the ore, no information regarding the process used to produce the concentrates, no defined method of turning the concentrates into precious metal. Dr. Smith and the Company CEO met and defined this project. This action supports the Company mission statement to “…maintain compliance with industry standards.” Dr. Smith was at the mine site the week of May 14, 2018 and completed his preliminary work. He collected two samples of head ore, each greater than 10 kilograms. These two samples were collected at previous sample sites EC-10 and EC-11 (Ref NI 43-101). These two sites were selected because of the relatively higher content of precious metals during the initial assay procedure. These samples were transported, under chain of custody protocols, for testing by Dr. Smith. The following phased plan has been initiated.

Analytical

This is the assay portion of the project. A determination of what is contained in the material being tested. Is there sufficient precious metal to make this project potentially profitable? This phase can be done rather rapidly. And from past experience the results of this phase should be positive.

Bench Scale

This is the portion of the project that determines the extraction method to be used to separate the precious metals from the iron ore. There are various methods available and ECPN will select the method that is most cost effective, least harmful to the environment, and repeatable in a large-scale production environment.

Bulk Scale

This phase utilizes the methods identified in the Bench Scale phase and implements them in a mini production environment. During this phase the amount of material processed could be on a scale of tons. Once a firm scale model is developed and tested, the Company would then be capable of building a Pilot Plant at the mine site replicating the Bench Scale model.

Pilot Plant

The Pilot Plant would be constructed at the mine site. The capacity of production would be determined at that time, but it is expected that revenue generated could be significant. As this work continues the shareholder community will be informed of the progress.

Additional Updates:

- The concentrates shipped to Canada have been located and positive communication between the parties is ongoing. The sides are negotiating the protocol for the return of the material.

- While at the mine site, Dr. Smith collected approximately 20 kilograms of “concentrated” material. This material will the assayed to determine the potential value. If positive results are achieved further testing will commence with the goal of turning this material into revenue for the Company. The concentration level of this material is not known and the quantity is undetermined.

- The iron ore project proposal which was received by the previous management group has never formally been presented to the Board of Directors. There has been no review or discussion, but the Company’s understanding is that there is a Letter of Intent as well as a Non-Disclosure Agreement. The Board of Directors has not made a decision related to this project.

- Funds to finance the phased testing program, the return of the concentrates, and immediate cash requirements have been secured from members of the Board of Directors.

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

![]() Download this Business Update May 11, 2018

Download this Business Update May 11, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company:

The company has had a long and mutually beneficial relationship with Auric Metallurgical Labs (www.auriclabs.com) in Salt Lake City, Utah. In the most recent past they have provided testing analysis for the Company. Also, in April of 2018, head ore samples were collected from the mine site and shipped to Auric for analysis; the OPT (ounces per ton) of the gold was .36. Based on these results the company contracted Dr. Clyde Smith to begin a testing and developing a project that would eventually turn into a pilot/production plant. This phase will begin immediately. Dr. Smith will be at the mine site during the week of May 14, 2018. He will collect two representative samples of approximately 10 kg each from selected sites on surface at the mine site. These samples will be delivered to Auric no later than May 18, 2018. These samples will be personally transported by Dr. Smith as to not break the chain of custody. Auric, in conjunction with Dr. Smith, will develop an Amenability test to achieve the optimum extractions of the precious metals from the samples collected. Similar work was done on six samples in 2005 and indicated very favorable results. New samples are required because the earlier work is dated and chain of custody of those samples is now broken. In joint testing by Dr. Smith and Auric, the Company is establishing third-party verification as it develops this phase of the project. This work should be completed in approximately three weeks. The funds for this phase have been provided by a Board member. Assuming favorable results from this phase of the project, work will begin on a bulk-scale test to define the parameters for scaling up to pilot/production plant operations. There have already been preliminary discussions with a contract miner to work with the Company in the development and operation of the pilot/production plant. While at the mine site, Dr. Smith has been authorized to collect one 10-kg sample from the 20 tons of concentrates returned from China and transport them to Auric for testing. These results will be made available as soon as testing is complete.

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning predictions of economic performance and management’s plans and objectives constitute forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements are statements that are not historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the expected completion, timing and results of metallurgical testing, interpretation of drill results, the geology, grade and continuity of mineral deposits, results of initial feasibility, pre-feasibility and feasibility studies and expectations with respect to the engaging in strategic transactions. All of such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Specifically, there can be no assurance regarding the timing and terms of any transaction involving the Company or its El Capitan property, or that such a transaction will be completed at all. In addition, there can be no assurance that periodic updates to the Company’s geological technical reports will support the Company’s prior claims regarding the metallurgical value and make-up of the ore on the New Mexico property. Additional risks and uncertainties affecting the Company include, but are not limited to, the possibility that future exploration, development, testing or mining results will not be consistent with past results and/or the Company’s expectations; discrepancies between different types of testing methods, some or all of which may not be industry standard; the ability to mine precious and other minerals on a cost effective basis; the Company’s ability to successfully complete contracts for the sale of its products; fluctuations in world market prices for the Company’s products; the Company’s ability to obtain and maintain regulatory approvals; the Company’s ability to obtain financing for continued operations and/or the commencement of mining activities on satisfactory terms; the Company’s ability to enter into and meet all the conditions to consummate contracts to sell its mining properties that it chooses to list for sale; and other risks and uncertainties described in the Company’s filings from time to time with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

![]() Download this Business Update May 9, 2018

Download this Business Update May 9, 2018

The El Capitan Board of Directors reports the following updates on the state of the Company

Operational State

The company currently has no on-going operations at its New Mexico mine site. Twenty tons of head ore concentrates which had previously been shipped to China have been returned and are currently at the mine site. The AuraSource 1 machine is on the mine site. The company had recently shipped approximately 2,000 pounds of head ore hyper-concentrates to Canada for further processing, but the location and status of such concentrates is not currently known and is under active investigation by the Board. The containers were sealed prior to shipment and hopefully remain intact. If the concentrates are located and returned and are in their original state, they will be smelted and refined as quickly as possible.

Financial State

The company currently has over $1,000,000 in accounts payable and has a minimal amount of cash available. The Company’s most immediate potential cash sources are from processing the concentrates returned from China, and well as processing the concentrates previously shipped to Canada, if the shipment can be found and recovered. In the interim, the Company will be looking to borrow funds via short term loans. We understand that there is currently a group of shareholders and current directors who are actively considering forcing the company into bankruptcy. We fear this is being done with a view to purchase the mine assets on a highly discounted “fire sale” basis, thereby wiping out the current equity and perhaps even debt holders of the company. This would be directly against our mission statement, and the majority of the Board is doing all it can to avoid this result.

Mission Statement

The mission of El Capitan Precious Metals, Inc. is dedication to serve its shareholder with the highest integrity, maintaining compliance with industry standards, consistently striving to maximize return to the shareholders, insure business matters are conducted in the highest of ethical standards, deliver business with a sense of warmth, friendliness, individual pride, and company spirit.

Future State

The company will be actively pursuing numerous avenues to maximize shareholder value. We will begin testing immediately the Chinese concentrates and developing an operational plan to eventually turn them into revenue. We will continue to develop the iron ore potential. We are currently developing a Business Plan which will include specific avenues to limited production, ongoing marketing and sales objectives, and prospects of a sale and/or a joint venture partner. ![]() Business Updates May 9, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) May. 1, 2018

Business Updates May 9, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) May. 1, 2018

Gamba Report Identifies Massive Iron Ore Deposits at El Capitan Mine

Geologist’s Study Estimates Inferred Reserves at 480,000,000 Tons of Mineable Iron

Scottsdale, Arizona – El Capitan Precious Metals, Inc., (OTC/QB: ECPN) reported today on the findings of a study conducted by Maria Teresa Gamba that identified a minimum of 480,000,000 tons of inferred reserves of mineable iron at the El Capitan mine site in New Mexico. Maria Gamba, senior geologist from Sinectica Geoenv.Cons. LLC FI USA and author of the report, stated that the Company holds a property with “vast iron ore deposits” and a “massive presence of mineable iron minerals.” Gamba visited and evaluated the property in mid-October of 2017 and, as a result of that field campaign, she concluded that El Capitan is, indeed, a “rich iron ore project” and reported that the “vast iron ore deposits” clearly belong to “the skarn-type iron ore deposits.” Skarn deposits are economically valuable as sources of metals such as tin, tungsten, manganese, copper, gold, zinc, lead, nickel and iron. The letter to the Company from Sinectica Minerea reads, in part:

“As a result of this short field campaign I am able to confirm that El Capitan Project is a vast iron ore deposit who clearly belongs to the skarn-type iron ore deposits. “The importance of their economic value is evident due to the quality and quantity of the minerals present in the claims. Even when the tonnage needs to be quantified in forthcoming processing campaigns, it is possible to assure millions of mineable tons. Inferred reserves quantified during this prospecting trip had been estimated in a minimum of 480,000,000 tons of mineable iron materials. “During this campaign, field methodology included geological and structural studies in order to determine the metallogenic model; rock sample and magnetic studies. Geochemical and precious metals analysis were carried out by handheld Olympus Spectrometer…Tonnage calculated in mined minerals, outcrops and profiles. “Field work confirmed massive presence of mineable iron minerals.”

Gamba’s credentials are both extensive and impressive. She holds two Masters degrees, including one in Geological Sciences from the University of Buenos Aires, and has submitted her PhD thesis. Gamba is currently Manager in Mining, Geological, Petrophysical and Environmental for Sinectica Associated Consultants LLC. In her career, Gamba has held several positions with the United Nations, is extensively published (including a 2008 paper which was co-authored with David Davidson) and is well-regarded as both a teacher and lecturer in Argentina. Her field experience as an environmental geologist spans the globe and she has spearheaded Impact Studies and Research Projects across South America for nearly three decades. Chairman and CEO John F Stapleton stated that this report “represents yet another milestone in quantifying the value of the Company’s asset and paves the way to a production plan to monetize these massive amounts of iron ore in combination with previously identified precious metals.” Read Maria Gamba’s letter here: ![]() Gamba Report Maria Gamba’s CV is included here:

Gamba Report Maria Gamba’s CV is included here: ![]() María Teresa Gamba: Currículum Vitae

María Teresa Gamba: Currículum Vitae ![]() Business Updates May 1, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Apr. 13, 2018

Business Updates May 1, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Apr. 13, 2018

El Capitan Precious Metals Reports Breach of Contract by Buyer of Concentrates

Scottsdale, Arizona – El Capitan Precious Metals, Inc., (OTC/QB: ECPN) reported today that the Company was informed on March 30, 2018 that the contracted buyer to purchase and process the concentrates from El Capitan Precious Metals had decided not to process the material and, instead, offering to ship the material back to El Capitan Precious Metals. This information was relayed by legal counsel for the purchaser in response to inquiries by the Company regarding the timely payment for the recovered metal that El Capitan Precious Metals had been informed had been successfully recovered from the concentrate material over the 60 days prior to the contracted payment date. El Capitan Precious Metals is investigating the matter and will take all necessary and proper steps to pursue civil and criminal litigation of the matter if appropriate upon further investigation once the material is returned. The Company will provide more details at the 2018 Shareholder Meeting scheduled for Wednesday, May 23 in Scottsdale, Arizona. It will be held at the Gainey Ranch Golf Club and is scheduled to begin at 10:00 am local time. The meeting agenda will include detailed updates on operations and revenue generation. ![]() Business Updates Apr. 13, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Feb. 26, 2018

Business Updates Apr. 13, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Feb. 26, 2018

El Capitan Precious Metals Elects Doug Sanders to its Board of Directors

Scottsdale, Arizona – El Capitan Precious Metals, Inc., (OTC/QB: ECPN) announced today that Doug Sanders has been elected to serve on its Board of Directors, effective immediately. Sanders, an El Capitan shareholder for nearly 10 years, brings a wealth of knowledge and experience to the Company. His experience in construction and project management spans four decades and is both varied and extensive. His career has included work in heavy civil construction and pipeline construction and rehabilitation, with roles and responsibilities running the gamut from Project Manager to Division Manager to Executive VP/General Manager The Company has utilized Sanders’ expertise in a variety of ways over the past decade—from monitoring off-site sample testing and overseeing ore shipments to building-design consulting at the mine site—and he has served as a consultant and Advisory Board member for several years. Board Chairman John F Stapleton stated that the Board believes Doug Sanders will be a valuable addition and brings a very specific mix of background and experience that complements the existing strengths of the Board. Sanders will attend the upcoming Shareholder Meeting and Stapleton confirmed that the Company has scheduled its 2018 Shareholder Meeting for Wednesday, May 23 in Scottsdale, Arizona. It will be held at the Gainey Ranch Golf Club and is scheduled to begin at 10:00 am local time. The meeting agenda will include detailed updates on operations and revenue generation. ![]() Business Updates Feb. 26, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Feb. 19, 2018

Business Updates Feb. 26, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Feb. 19, 2018

The El Capitan Board of Directors reports the following updates:

Johnson Matthey

In October of 2017, El Capitan Precious Metals, Inc. sent Johnson Matthey a 3.37-pound ingot. The bar was smelted using copper as a collector for platinum. Johnson Matthey, a world leader in refinery and material science, refined and assayed the material and reported a yield of 5.904 troy ounces of platinum. On January 24, 2018, Johnson Matthey wired net funds of $4,362.67 to the Company. The Company paid Johnson Matthey $1,500 in standard processing fees on the transaction.

Staking and Filing Additional Mining Claims

Earlier this month, on February 13, the Company filed additional mining claims with the State of New Mexico on an additional 2,000 acres.

10-K Audit

The Company has engaged the accounting firm of Semple, Marchal & Cooper LLP to complete its 10-K audit. All details are available in the Company’s 8-K. The original audit firm determined that they were unable to complete and certify the El Capitan audit due to the fact that they required a legal opinion from the Company concerning the issuance of stock for services during the prior period of several years. The Company determined that a legal opinion could not be provided without unreasonable effort and expense—if at all. The audit firm resigned the account on February 5, 2018. The 10-Qs for the prior three quarters have been amended, the 10-K for fiscal year 2017 will be filed as soon as possible. The 10-Q for Q1 of 2018 will be filled immediately after the 10-K filing. According to Board Chairman John F Stapleton, the challenges in completing the audit will not impact the Company in any way. All necessary extensions have been granted.

Shareholder Meeting

The Company has set a date for its 2018 Shareholder Meeting in May of this year. The scheduling change, from March to May, was made to accommodate the Company’s plan to present an expanded meeting agenda that will include detailed operations and revenue updates. According to Stapleton, the Company will use those 90 days to “gather product information from operations as well as details on avenues for positive cash flow that is expected to result from the sale of iron ore and precious metals concentrates over the next several months.” The El Capitan Shareholder Meeting will be held in Scottsdale, Arizona on Wednesday, May 23, 2018 at the Gainey Ranch Golf Club. The meeting is scheduled to begin at 10:00 am local time.

Resignation of Clyde Smith

The Company has accepted the resignation of Dr. Clyde Smith from the El Capitan Board effective February 7, 2018. Dr. Smith’s decision, as stated in his resignation, was based upon the fact that the Company does not have access to metallurgical data on the recovery process, data which is confidential to the Pilot Plant operator. The Company thanks Dr. Smith for his loyal service to El Capitan Precious Metals, Inc. ![]() Business Updates Feb. 19, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Jan. 25, 2018

Business Updates Feb. 19, 2018: Updates from the El Capitan Board of Directors (Business Release PDF) Jan. 25, 2018

The El Capitan Iron Ore Opportunity

The Company posts the following informational update today:

The El Capitan property was originally evaluated as a potential iron ore mine during World War II. When the war ended, the interest in mining iron ore was no longer a national priority and the work and research related to iron ore was filed away for possible use in the future. Many years later, in the latter part of the 20th century, additional work was done. Analyzing the broader resource determined that the property contained significant amounts of precious metals, in additional to iron ore. The discovery of precious metals in the iron ore presented two issues in terms of monetizing the ore:

• Separating the precious metals from the iron ore

• Managing the excess iron ore after separation as the U.S. Forest Service does not allow the ore to be stockpiled on the property

To address the ore’s complexity, the Company entered into an agreement with a contract miner to devise a system to separate the precious metals from the iron ore minerals. The initial separation is done at the mine with a AuraSource device. The contract miner developed and built the “fine grinding device” during 2016 and 2017 to hyper-concentrate the AuraSource concentrates. The contract miner’s fine-grinding system produces a hyper-concentrate with the precious metals separated from much of the remaining iron-bearing ore and other unwanted minerals. The product produced by the fine grinding, separation process is then smelted in preparation for refining the precious-metals product.

Since the iron product must be removed from the mine site, the Company is creating a program to sell its iron ore. In July of 2017, Board Chairman John Stapleton met with a major steel company to discuss their plans to build an iron ore processing plant in New Mexico. This development, in conjunction with the Federal Government’s intentions to use domestic resources for one or more large infrastructure projects in the continental United States, presents the possibility of a large revenue-producing opportunity for the Company.

The Company believes the El Capitan property with its expanded acreage has the potential for significant tonnage of iron ore. The Company is optimistic that it would be economically feasible to enter into an agreement with a processor or buyer to take the El Capitan project into production.

In November of 2017, the Chairman and a board member met with an internationally recognized geologist and a representative from an entity that is considering the extraction and necessary separation of the El Capitan ore into a precious metals hyper-concentrate and an iron product. Following that meeting, the Company entered into discussions to define an agreement with this entity to process the iron ore at the El Capitan mine site and transport the iron product to the processing site. It is anticipated that the precious metals concentrates will be processed separately.

![]() Business Updates Jan. 25, 2018: Iron Ore Opportunity (Business Release PDF) Jan 24, 2018

Business Updates Jan. 25, 2018: Iron Ore Opportunity (Business Release PDF) Jan 24, 2018

Informational Update

The Company posts the following informational update today:

“In spite of the many challenges, the Pilot Program has demonstrated extraordinary accomplishments for the Company. This is best illustrated by the progression from assays to precious metals recovery and sale. Pilot Plant operations have been successfully completed and the methods for recovery have been proven.” – Board Chairman John F Stapleton

The following 4 slides recap those activities and detail the timeline. Hover your mouse or tap the screen to be able to click through the slides.

![]() Presentation Files for Download Business Updates Jan. 24, 2018 (Business Release PDF) Jan 4, 2018

Presentation Files for Download Business Updates Jan. 24, 2018 (Business Release PDF) Jan 4, 2018

El Capitan Precious Metals Executes Contract with Precious Metals Buyer

Scottsdale, Arizona – El Capitan Precious Metals, Inc. (OTC/QB: ECPN) announced today that an agreement was executed in December for the sale of its precious metal hyper-concentrates. El Capitan Chairman and CEO John F Stapleton reported that the Company reached a final agreement with a buyer and has executed a Purchase Agreement for all remaining hyper-concentrates produced by the Pilot Plant from the concentrate materials stored at the bonded warehouse in Tucson, Arizona. This sale represents the last El Capitan Pilot Program activity. It successfully completes the goals of the Pilot program, as well as demonstrates several small-scale recoveries, (5–15 pounds of hyper-concentrated material recovery of precious metals) proving the recovery technology. This sale of the remaining hyper-concentrated material to the buyer, who will smelt and refine the remaining material, demonstrates recovery and technology on a larger scale. Per the terms of the agreement, “settlement and payment shall be a minimum of 60 days following receipt of material of sampling completion, should representation be utilized.” This transaction protocol utilizes an industry standard: Upon receipt of the concentrates the buyer will assay the material utilizing an outside representative. This assay will be compared to an independent assay performed by El Capitan. If there is a significant difference between the two, an independent umpire will be engaged to resolve the difference. Both parties agree that, in the event of a dispute or discrepancy, the entity’s valuation closest to the umpire’s will prevail. The Pilot Program began with the development and testing of a hyper-concentration device built in China in late 2016 and shipped to the United States in the first calendar quarter of 2017. The device was installed and modified to operate in the United States in the second calendar quarter of 2017 and has processed all the concentrates from the Tucson warehouse into hyper-concentrates. After considerable experimentation and modifications during mid-2017, the Company was pleased with the effectiveness of the technology and the end results achieved. The Pilot Program achieved its purpose of proving the technology through precious metals recovery as of the end of 2017. El Capitan is evaluating all the data generated by the Pilot Plant to determine the appropriate pathway to a Production Plan. ![]() Business Updates Jan. 4, 2018 (Business Release PDF)

Business Updates Jan. 4, 2018 (Business Release PDF)